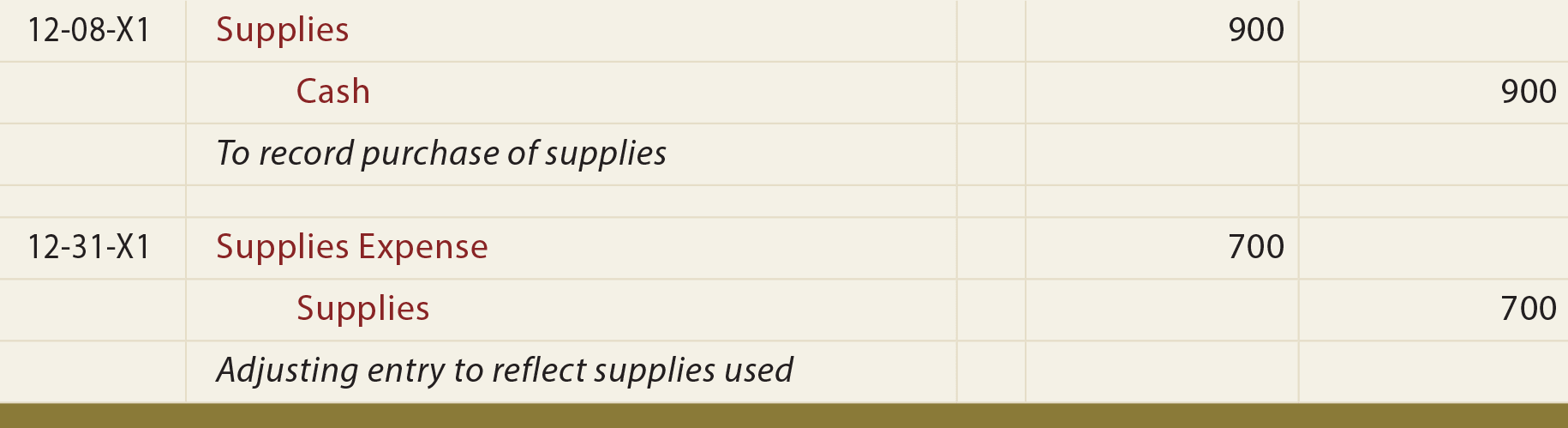

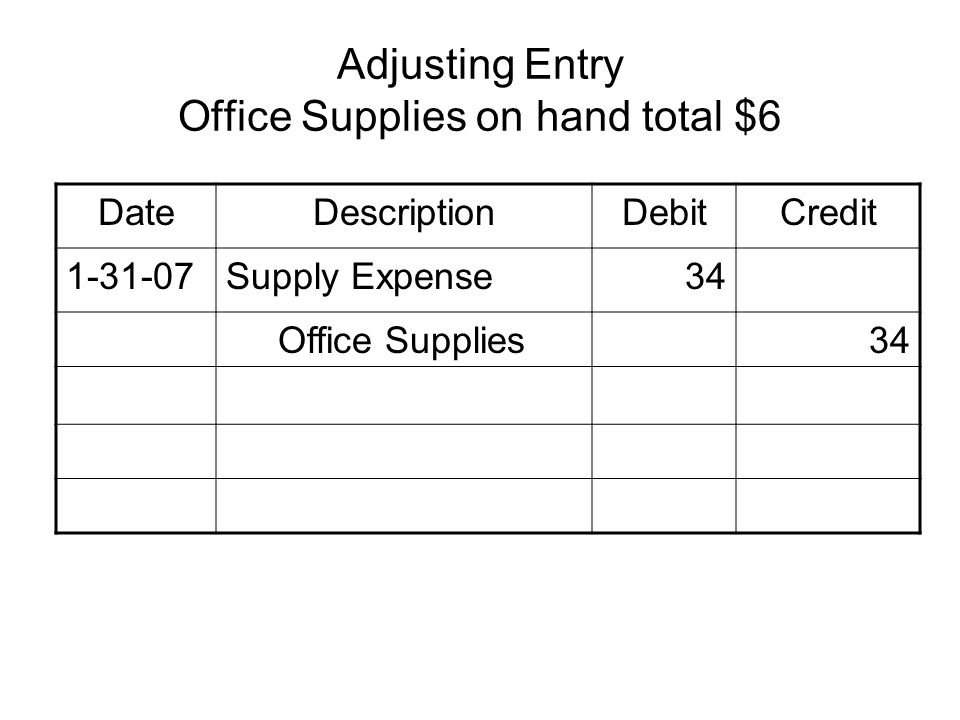

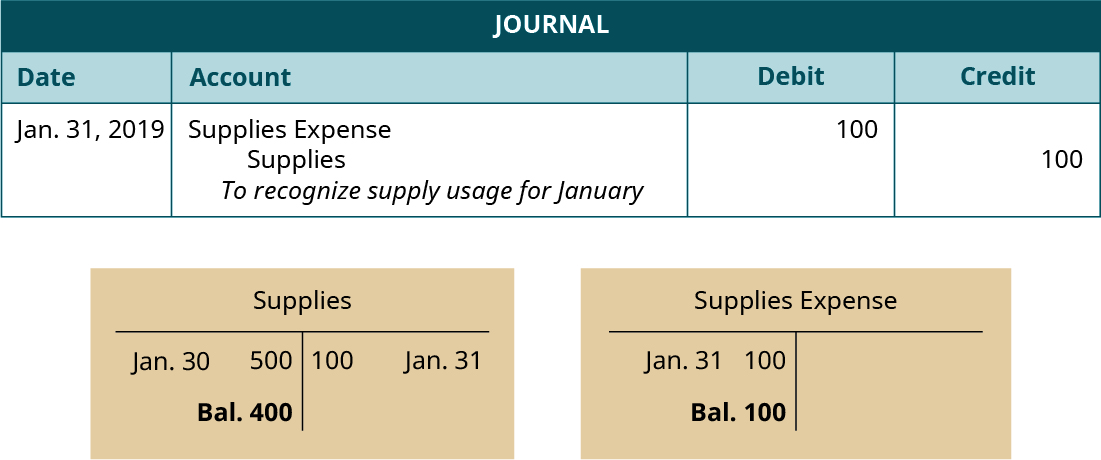

The supplies expense is an expense account. Write supplies on the line directly underneath the supplies expense entry.

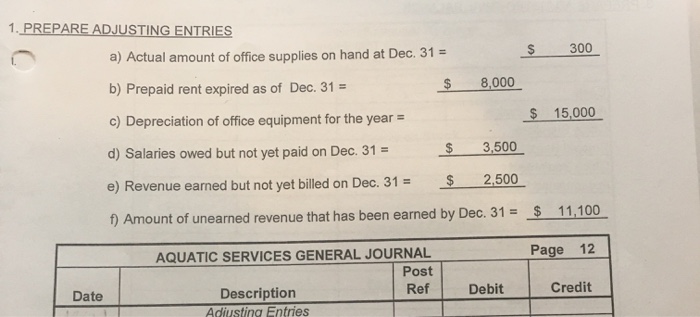

Solved Prepare Adjusting Entries A Actual Amount Of Office Chegg Com

Ad See How Journal Entry Automation Allows You to Build Sustainable Processes into the Close.

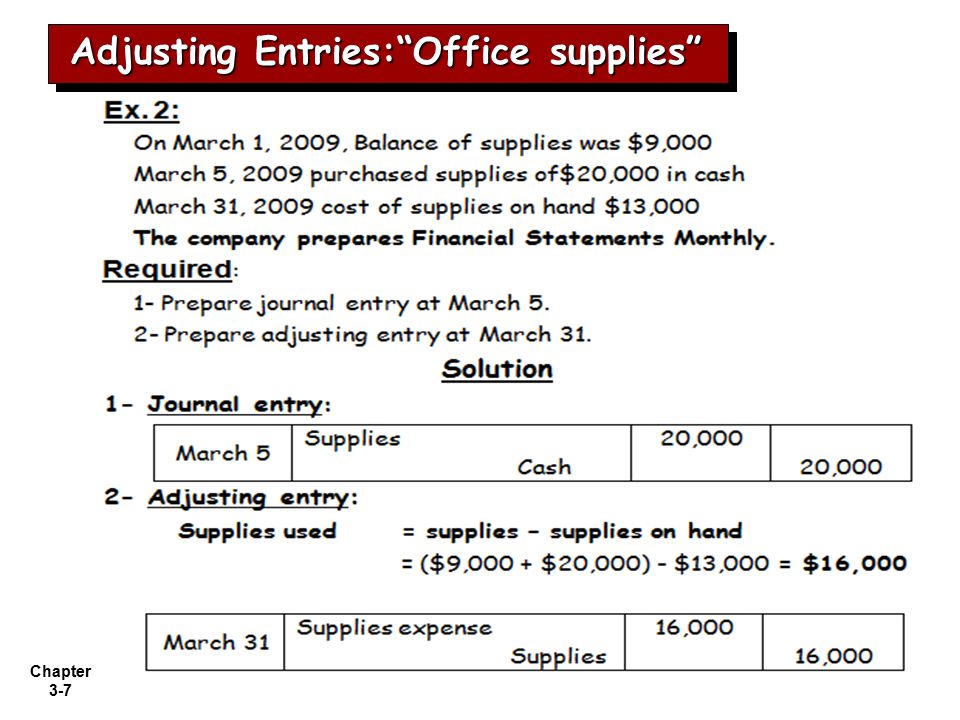

. Office supplies are items used to carry out tasks in a companys departments outside of manufacturing or shipping. These entries involve at least two. The general journal entry made by Willow Rentals will include.

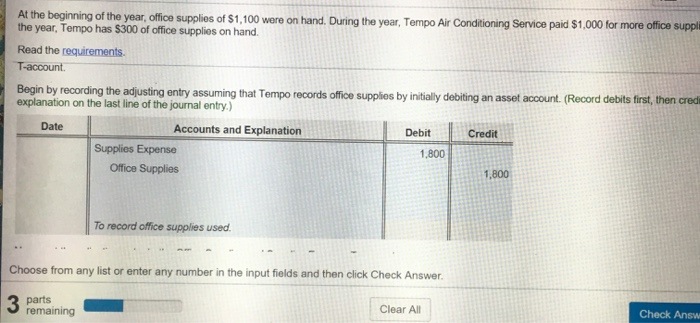

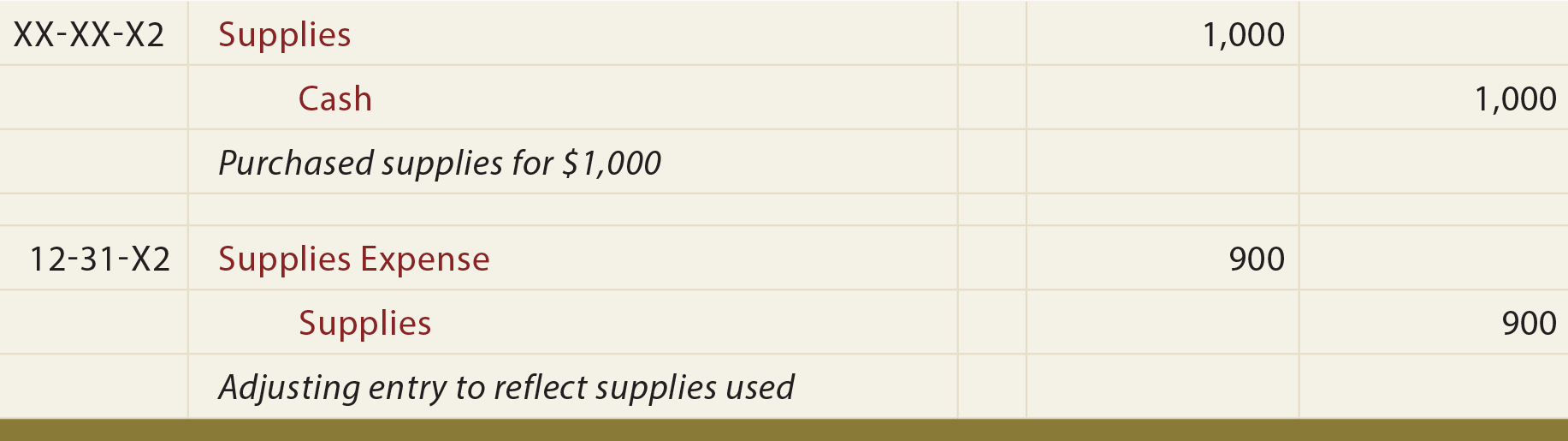

Thus consuming supplies converts the supplies asset into an expense. Despite the temptation to record supplies as an asset it is. Make Adjusting Entries.

Likewise we can make the journal entry for supplies consumed at the end of the accounting period by debiting the 2000 into the. Debit the supplies expense account for the cost of the supplies used. Modernise Accounting Processes and Embed Agility in Day-To-Day Accounting Operations.

Supplies consumed 1500 500 1000 2000. Is the left-hand side of a t-account. When we credit it we are decreasing it.

When a business purchases consumable supplies such as stationary it records these as supplies on hand in the balance. Supplies on hand refers to the stock of on-hand supplies of consumable items that is typically maintained by a. Balance the entry by crediting your supplies account.

Consumable Supplies Expense Recorded. Ad See How Journal Entry Automation Allows You to Build Sustainable Processes into the Close. Company ABC plan to pay the 2500 at a later date.

In the world of double-entry bookkeeping every financial transaction affects at least two accounts. Given the fact that there is a multitude of items. Office Supplies An Explanation.

Supplies on hand definition. At the end of the accounting period a physical count of office supplies revealed 2350 still on hand. Office Supplies Expense Cr.

Modernise Accounting Processes and Embed Agility in Day-To-Day Accounting Operations. In the case of office supplies if the. The following journal entries are created when dealing with Office Supplies.

At the end of the year the following journal entries are created in case. For example if you used 220 in supplies debit the. Company ABC purchased Office supplies on account costing 2500.

The supplies on hand is an asset account. The appropriate adjusting journal entry to be made at the end of the period would be. Office supplies are likely to include paper.

The office supplies account is an asset account in which its normal balance is on the debit side. Credit to accounts payable. To provide accurate supplies on hand reporting make adjusting entries to adjust revenues and expenses.

Write the same amount in the credit column that appears in the debit column for supplies expense. It is the expense of actual supplies that we used. Likewise the credit of office supplies in this journal entry represents the office supplies used.

Willow Rentals purchased office supplies on credit. Are Supplies Credit or Debit. Office Supplies include copy paper toner cartridges stationery items and other miscellaneous desk supplies.

Adjusting Entries For Asset Accounts Accountingcoach

The Adjusting Process And Related Entries Principlesofaccounting Com

Solved At The Beginning Of The Year Office Supplies Of Chegg Com

Journal And Adjusting Entries Ppt Download

Record And Post The Common Types Of Adjusting Entries Principles Of Accounting Volume 1 Financial Accounting

The Adjusting Process And Related Entries Principlesofaccounting Com

0 comments

Post a Comment